Knowing your needs before you choose a broker will make your decision much easier. The analysts reminded clients that three years ago, Keith Block resigned as co-CEO after 18 months on the job and wrote that "the company seems to have struggled since.Before you can buy Slack stock, you must have an account with a reputable stockbroker. "The second elephant in the room is why Bret Taylor decided to give up his high-profile co-CEO and vice chair position after only a year," wrote the Guggenheim analysts, who have the equivalent of a hold rating on the stock. In a break from third-quarter tradition, Salesforce neglected to provide guidance for its next fiscal year.Īnalysts at Guggenheim wrote in a report that there were "two elephants in the room." The first was omitting guidance for the coming year. Its forecast for the fourth quarter is for growth of 8% to 10%.

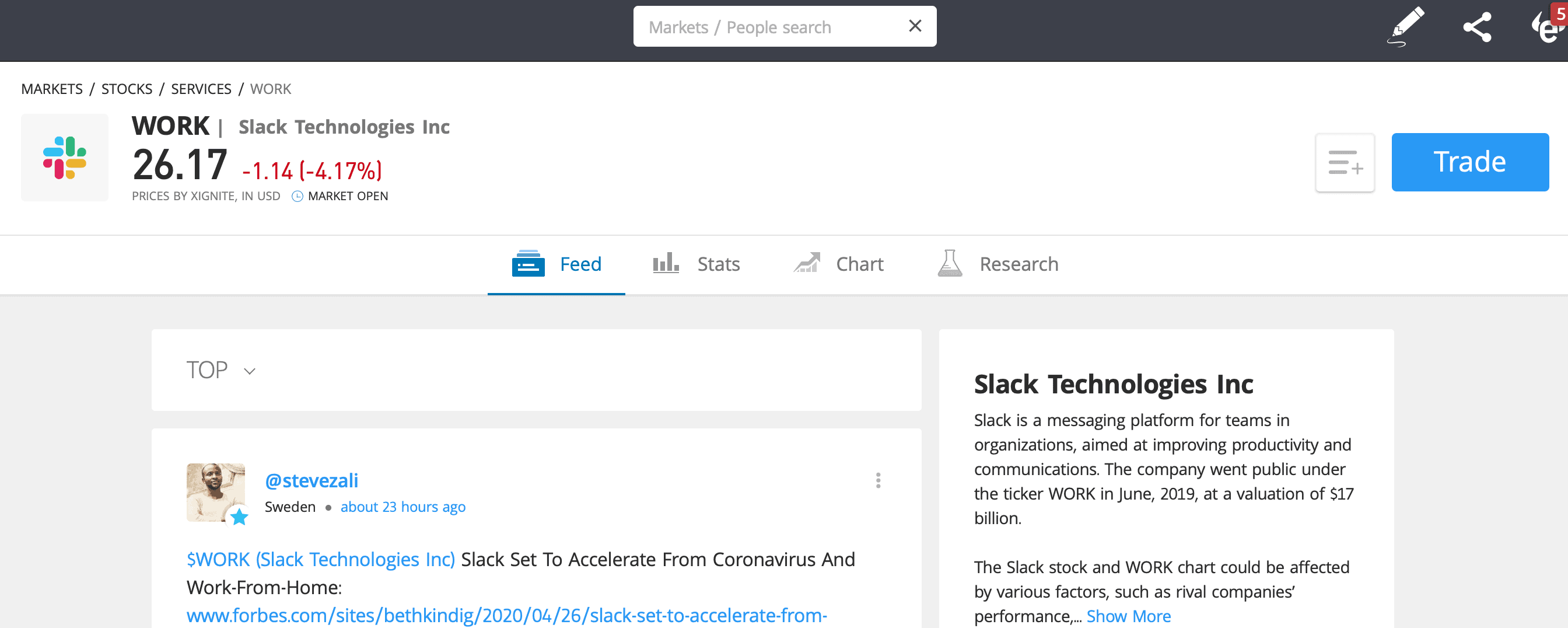

Last week, the company reported third-quarter revenue growth of 14%, the slowest expansion for any period since the company's IPO in 2004. Like its high-valued tech peers, Salesforce has been hurt this year by soaring inflation and rising interest rates, which have pushed investors into parts of the market deemed safer in a slowdown. Since then, it's lost 57% of its value, closing on Monday at $133.93. Salesforce's purchase of Slack closed in July 2021, and its stock peaked four months later at almost $310. 1 of that year, according to a filing with the SEC. Taylor reached out to Butterfield multiple times in August and September 2020 about a possible acquisition, and the two negotiated throughout the process, which culminated in an agreement announced on Dec. Taylor's name was all over the deal, even though he wasn't yet co-CEO. Salesforce was so jazzed about Slack's expansion that it paid over $27 billion for the company at a forward price-to-sales ratio of 24, one of the highest multiples ever in software.

#WHO OWNS SLACK STOCK SERIES#

In a series of tweets on March 25, 2020, Butterfield said the company had experienced "early signs of a surge in teams created and new paid customers unlike anything we had ever seen," adding that the shift from email to chat channels, "which we believed to be inevitable over 5-7 years just got fast-forwarded by 18 months." With workers forced to communicate remotely, Slack's popular chat app blew up. Slack was a pandemic-inspired acquisition. While Taylor and Butterfield are the highest-profile exits, they're far from alone among Salesforce's executive ranks. "As hackneyed as it might sound, I really am going to spend more time with my family (as well as work on some personal projects, focus on health and generally put time into those things which harder to do when one is leading a large organization)." "I'm not going to do anything entrepreneurial," Butterfield wrote in a Slack message that was viewed by CNBC. Taylor, who joined Salesforce in 2016 through the acquisition of his startup Quip, said he'd "decided to return to my entrepreneurial roots." Benioff said on the earnings call, "We have to let him be free, let him go, and I understand, but I don't like it."īutterfield made it clear that he's leaving for different reasons. Salesforce has now lost 47% of its value for the year, compared to the Nasdaq's 28% drop, and is trading at its lowest since March 2020, the early days of the Covid-19 pandemic. In the three trading days since the Taylor news landed alongside Salesforce's third-quarter earnings report, the stock has had two of its three worst days of the year, plunging 8.3% and 7.4%, respectively. Personal Loans for 670 Credit Score or Lower Personal Loans for 580 Credit Score or Lower Best Debt Consolidation Loans for Bad Credit

0 kommentar(er)

0 kommentar(er)